How Much Is Lubrication Costing You?

EP Editorial Staff | May 1, 2022

Evaluate yearly costs for replacement components that require lubrication to achieve cost avoidance.

By Mark Barnes, PhD CMRP, Des-Case Corp.

As consumers are seeing increased costs for everyday basics and unprecedented supply-chain disruptions, so to, manufacturers are facing the combination of increased costs for replacement parts, increased lead times for basic components, and a scarcity of consumable products. In many cases, this has forced companies to look at their costs and evaluate ways to reduce or eliminate unnecessary expenses.

This is particularly true of lubrication, where the cost of performing lubrication poorly can equate to 10% to 15% of a plant’s overall maintenance budget. Moreover, supply-chain disruption is creating issues with lubricant availability. Recently I heard of a company that was told by their lubricant supplier that they can only guarantee delivery of 50% of the lubricants the plant typically uses in any given year. This is not an isolated incident, forcing many companies to face the most basic of questions: “How much is lubrication costing me?” and “How can I reduce lubrication costs?”

Size of the prize

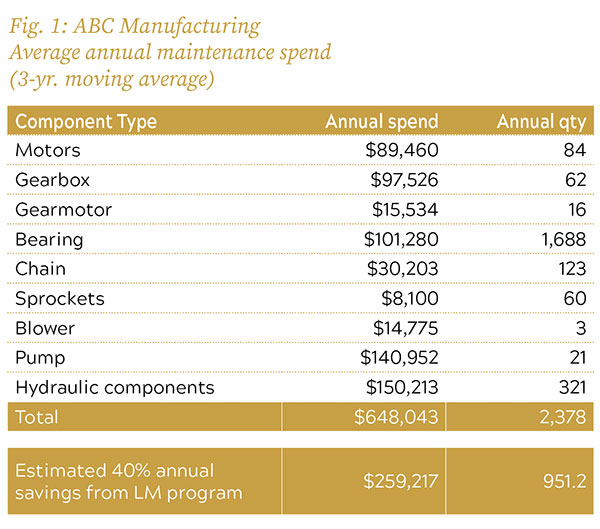

One simple way to look at the cost of lubrication is to look at MRO spend. By evaluating how much is spent each year on replacement components that require lubrication, such as bearings, pumps, gears, and chains, as well as hydraulic components, it becomes reasonably simple to evaluate the “size of prize” for lubrication-based cost avoidance.

The sheer number of bearings being replaced means that this plant is spending more than $100,000/yr. buying bearings.

Fig. 1 shows an example of annual MRO spend from a medium-sized production facility. From the data, it becomes immediately clear where the problem lies. In the three years from which the data was pulled, the plant averaged 1,688 replacement bearings every year and, while most bearings are small, meaning a relatively low cost to replace, the sheer number of bearings replaced means that this plant is spending more than $100,000/yr. buying bearings.

According to a leading bearing manufacturer, 63% of premature bearing failures are caused by lubrication-related issues. If this holds true for the plant, close to $65,000 is spent every year replacing bearings that have failed due to an inability to properly lubricate.

Next on the list is hydraulic components. While it would be nice to have greater granularity to show which components are replaced most often, overall, the plant is spending $150,000 every year replacing hydraulic components. Consider that 80% to 90% of hydraulic failures are due to hydraulic-fluid contamination and we can see that roughly $120,000 is being spent annually servicing contamination-induced hydraulic failures.

What is not listed in Figure 1 is the cost of lubricant purchases. In years past, oil was often considered to be a necessary consumable, relatively inexpensive in contrast to downtime and other operating expenses. In today’s world, that is simply not the case.

This plant exceeded their Q1 budget for lubricant purchases by 75%. This was driven by an increase in hydraulic fluid and grease purchases. Coupled with the MRO data, the issues become crystal clear. The plant is over-lubricating greased bearings, inducing failure while increasing costs for grease and failing hydraulic components. This is driving up hydraulic-fluid purchases due to leakage and full or partial drains to fix failed components.

Where most plants go wrong in evaluating lubrication costs is to only consider lubricant costs. Considered as a stand-alone, it might be tempting to look at re-negotiating the lubricant supply contract to achieve a price reduction or consider using less-expensive hydraulic fluid. Likewise, it is tempting to seek a lower-cost supplier for bearings or re-negotiate the fluid-power contract for hydraulic parts. Both are false economies. While costs may decrease in the short term, several years down the road the true impact of lower-quality lubricants or sub-standard replacement parts will be felt even more severely.

An obvious question is, “Why are bearings failing?” This is where many companies get bogged down, seeking data in the form of root cause failure analysis (RCFA) that simply does not exist, save for the few most costly failures where RCFA makes sense.

MRO spend and purchases

Instead, a more pragmatic approach is to look at MRO spend and lubricant purchases and pose a few simple “what if” questions: What if we could reduce bearing purchases by 40%? or, What if we systematically reduce lubricant volumes by 15% each of the next three years through proper lubrication, cleaner hydraulic fluid, and condition-based oil drains?

View excess MRO or lubricant costs as “losses.” When we think about cost avoidance, it’s easy to be skeptical if we talk about “saving” $120,000 on hydraulic component spend. Conversely, when we talk about “losing” $120,000 every year due to hydraulic fluid cleanliness, the call to action becomes more compelling and is more likely to be addressed by senior leadership.

One thing we haven’t considered is downtime costs. While some companies keep detailed downtime records, including the reason for specific minutes or hours of downtime, few, if any, companies can truly state how much downtime each year is specifically caused by lubrication. Fortunately, it’s often easy to justify improving lubrication practices simply on lower MRO, lubricant, and labor costs with production loss avoidance becoming a bonus.

Once the magnitude of lubricant losses has been established, it’s time to evaluate the costs to fix the problem. This might include using third-party support to develop new lubrication standards, upgrading or establishing an oil-analysis program, delivering training to technicians, or purchasing new fluid-management tools. A detailed project plan should be developed to address all key issues.

Putting it all together

In a world with ever-increasing costs, asking senior management for yet more money is often difficult. However, most companies continue to invest in projects that deliver either increased capacity or reduced costs and that is exactly why we must think about lubrication cost avoidance as an investment.

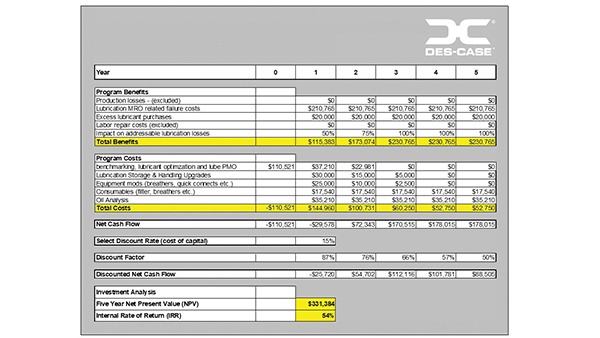

Fig. 2 shows a five-year lubrication business case where estimated losses (remember, losses not savings) are listed together with the incremental cost to improve current lubrication practices. In doing so, we need to be realistic. If we have lost close to $120,000 due to dirty hydraulic fluid each of the past three years, is it reasonable that we can reduce all of this in the first year? Instead, discounting cost avoidance by 50% in year one and 25% in year two, before finally realizing the full benefits in year three and beyond, seems far more realistic.

We also must be mindful that companies don’t have unlimited capital. Most companies have a “cost of capital” that determines the long-term value of an investment in today’s dollar (net present value or NPV) and an internal rate of return (IRR) that determines whether an investment makes sense.

By presenting the project as an investment, it is far more likely that senior management will support the project, particularly if accompanied by MRO and lubricant costs and specific examples of where lubrication could have been improved throughout the plant. In essence, the business case shown in Fig. 2 becomes a value statement that reads: Each year we lose around $210,000 from failed equipment and $20,000 in excessive lubricant purchases. By investing $110,000 upfront as well as smaller investments over the next three to five years, we stand to eliminate $331,000 in costs over the next five years, which will yield an annual rate of return of 54%.” Described in that manner, it’s hard to see how a company could not invest. EP

Mark Barnes, CMRP, is Senior Vice President at Des-Case Corp., Goodlettsville, TN (descase.com). He has 21 years of experience in lubrication management, oil analysis, and contamination control.

View Comments